Taking Away the Punch Bowl

Spiking the punch bowl at an Alcoholics Anonymous party is about as mean a trick a person could play. It is, however, guaranteed to energize things. This is exactly what Ben Bernanke did to the economy. But now that the cheap money is running out, this is one party that is about to turn ugly.

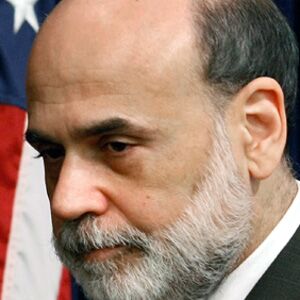

In June, Federal Reserve Chairman Ben Bernanke is scheduled to end the Fed’s second round of quantitative easing. This is the program by which the Federal Reserve is creating $600 billion out of thin air to lend to the government. More than one third of every dollar the government is borrowing is money printed up out of fiat by the Fed.

And debt-addicted America needs to borrow a lot of money—at least $1.6 trillion this year, according to the most recent estimates.

“Free” money, like debt, is intoxicating. It can produce temporary feel-goods, but they never last. Then when all the alcohol is gone, all of a sudden reality arrives—and with it one massive headache. Will the stock market crash? Will the banking system freeze up? Will the world end?

The unknowns are legion. That is what happens when authorities engage in unprecedented meddling. No one knows exactly what will end up getting broken. Will America’s foreign lenders abandon it? Will interest rates skyrocket? Will the housing market get whacked again?

And what about the sickly dollar?

The key to understanding how America’s economic breakdown will proceed is understanding that sovereign nations need not ever go bankrupt, says commodities and foreign currency specialist Jim Sinclair. “You must realize they simply refer to quantitative easing as policy. You must realize that it is the currency that breaks, not the country” (emphasis mine).

According to Sinclair, America has passed the point of no return. The government has no choice but to continue printing money “to infinity.” It is the only tool left in its toolbox to fight debt collapse, he says. QE3 is all but a given, even if the Fed does repent for a while.

This is a view that seems to be supported by Pimco, the largest bond investor in the world. For virtually all of the fund’s history, its largest investments have been U.S. treasuries. But earlier this month, the fund announced it had done something unprecedented—it sold all its government-related debt from its flagship fund.

That’s right: every single bond, bill and note. It now owns nada, zip, zero. It has gone cold turkey. That is how much faith the biggest lender in the world holds in the United States of America. In case you are wondering, Pimco’s Total Return Fund has assets worth well over $200 billion (much of which it used to lend to the government). All told, Pimco manages around $1 trillion worth of investments.

It is a telling sign of how precarious America’s financial situation really is.

On March 9, Bill Gross, the co-founder and chief investment officer of Pimco, asked: Who in their right mind would buy treasuries at their current rate of return? He noted that the Fed is currently using freshly minted funny money to buy nearly 70 percent of all U.S. government treasuries, with the balance absorbed by the Chinese, Japanese and others. He called it a Ponzi scheme that can’t help but eventually collapse.

In June, when the Fed stops buying, it will be D-day for treasuries, he said. Expect a bloodbath.

And since Gross made those comments, the massive earthquake and tsunami in Japan practically guarantee that Japan will not be a major lender to America again—and may even need to sell its treasury holdings.

So where will the government find people trusting enough to lend it another trillion and a half over the next year? Where will it find enough groggy dupes willing to be paid back with limitless federal monopoly notes?

Sudden withdrawal could send the economy spiraling. The dollar will crash. Retirement savings will be lost. Gasoline, natural gas and food prices will skyrocket. The worst hangover ever will have arrived.

It will be even worse than what Britain is going through now. Over the weekend, 250,000 people took to the streets of London to protest government cuts. Britain does not have the quantitative easing luxury that America does. The pound has almost completely lost its reserve currency status, so the government is trying to balance the budget the traditional way: cutting spending and raising taxes. The Bank of England could not risk just printing up $130 billion to balance the budget.

Those kind of protests—the anger, the violence, the outrage—are guaranteed to boil to the surface. And they will come to America. Wisconsin recently got a small taste, but they are coming to Sacramento, and Chicago, and Washington too. And they will be bigger and more vicious than anything America has experienced before, because America’s whole debt-based, greed-induced, fiat fraud economic system is verging on failure.

The party is ending. The free alcohol is running out. The dollar is being destroyed. And America’s way of life is about to change forever. The days of mass uprisings are beginning.