World’s Largest Bondholder Shorts U.S. Treasuries

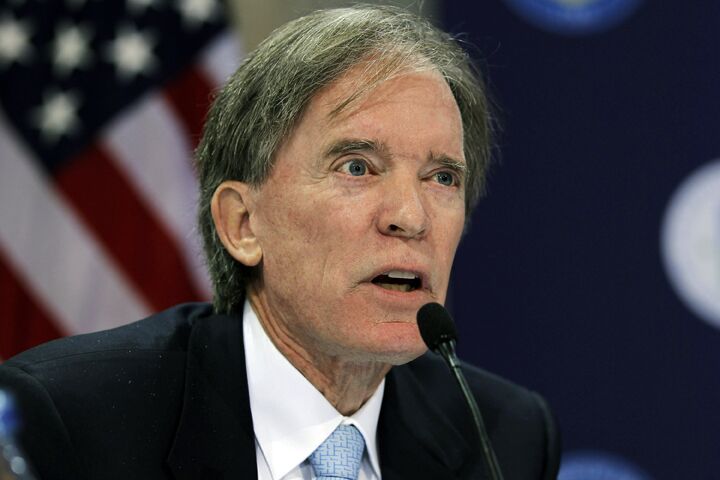

This past weekend it was revealed that Bill Gross, manager and co-founder of the $1.2 trillion Pimco family of bond funds, began shorting U.S. government treasuries. It is a startling development because it shows that the world’s most sophisticated investors are losing faith in America.

Last month, Gross revealed that his premier total return fund sold all of its U.S. government treasuries—a couple of hundred billion’ worth! The announcement shocked market commentators, with one analyst claiming the move was akin to Hershey’s getting out of the chocolate business.

Now it is revealed that Gross has not only sold his whole position, but he is doubling down by borrowing and selling treasuries from other investors, with the strategy of paying them back later when the treasuries plunge in price.

For many bond investors, U.S. treasuries are considered the new gold standard—the safest of investments. No more, says Gross. They are grossly overvalued and set for a major crash.

Why is Gross so negative? In essence, it is because the world’s largest economy is acting like Zimbabwe. Instead of balancing its budget by bringing tax revenues and spending into alignment, the Federal Reserve is monetizing the debt by creating money out of thin air.

In December, the Federal Reserve embarked on a second round of “quantitative easing,” which is really just a complicated term for Zimbabwe-style money printing. Since then, approximately 70 percent of all government spending has been provided by money brought into existence by fiat by the Fed. Over the past two years, the Federal Reserve has become the biggest lender to America—dwarfing even the Chinese and Japanese.

Without the Fed’s funny money, Republicans and Democrats would not be bickering over how to cut $60 billion in spending—it would be more like how to cut $1.5 trillion.

When June 30 rolls around, the date the Fed’s current $600 billion quantitative easing plan is scheduled to end, it will be D-day for government treasuries, says Gross. Who will lend the government money at these low rates?

That is why Gross is so negative. America’s borrowing needs are the biggest in history. Yet at the same time, America’s ability to pay its debts is reaching new lows. According to Gross, once the Fed is done juicing the market, interest rates will jump, and treasuries will plummet in value. That is how Gross thinks he will make his killing.

But for the rest of America, if what Gross predicts comes true, consumers will be the ones getting “killed.” That’s because if interest rates soar, everything in debt-addicted America becomes more costly. Making matters worse, not only will interest payments on the government’s debt rise, but the economy will slow and tax revenues will fall. And that means higher taxes and spending cuts forced on Americans. The recent budget battle (which ended Friday) will look silly considering what is coming.